By most accounts, the 2019 holiday sales season is expected to be a strong one. With consumers continuing to rely on web based research and purchasing to make a bulk of their purchases. Consumers are researching and buying earlier and earlier than in years past. Here are 25 2019 holiday shopping trends & statistics for the holiday retail season.

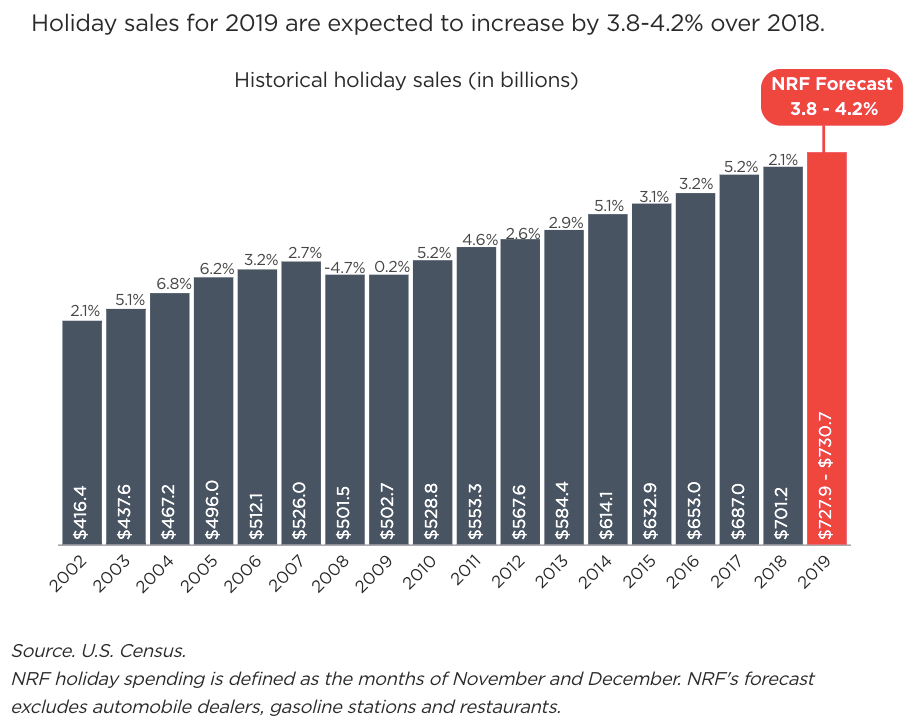

- Total US holiday sales (Nov – Dec) are expected to grow 3.8 – 4.2% according to the NRF. This puts total sales over $7.3 trillion. (Source: NRF)

- US ecommerce sales are expected to grow 11-14% to over $162.6 billion. (Source: NRF)

- Holiday ecommerce spending in 2019 is expected to grow 13.2% to $135.35 billion, with growth more than 3x total retail spending.(Source: eMarketer)

- $1,048 is the average amount US consumers plan to spend on holiday gifts and other items during the holiday season (4% increase from 2018). This breaks down to $659 on gifts for family and friends, $227 for non-gift holiday purchase and $162 on purchases for them selves. (Source: Winter Holidays Data Center)

- Americans tend to focus on price point as the most important purchase consideration with free shipping being the second highest consideration. (Source: Google Shopping Trends)

- 70% of US smartphone users rely on Google before buying something new. (Source : Google)

- 31% of online sales were made on a smartphone in 2018, which was a 24% increase over 2017. This growth will continue in 2019. (Source : Adobe)

- Shopper abandon their carts with 77% stating they regularly or occasionally abandon a cart when shopping online. (Source : Google)

- 48% of shoppers say they are open to buying from a retailer they have never purchased from during holiday season. In 2018 30% of them actually did purchase from new retailers. (Source : Google)

- 67% of shoppers still have shopping to heading into the last week of Christmas. (Source : Google)

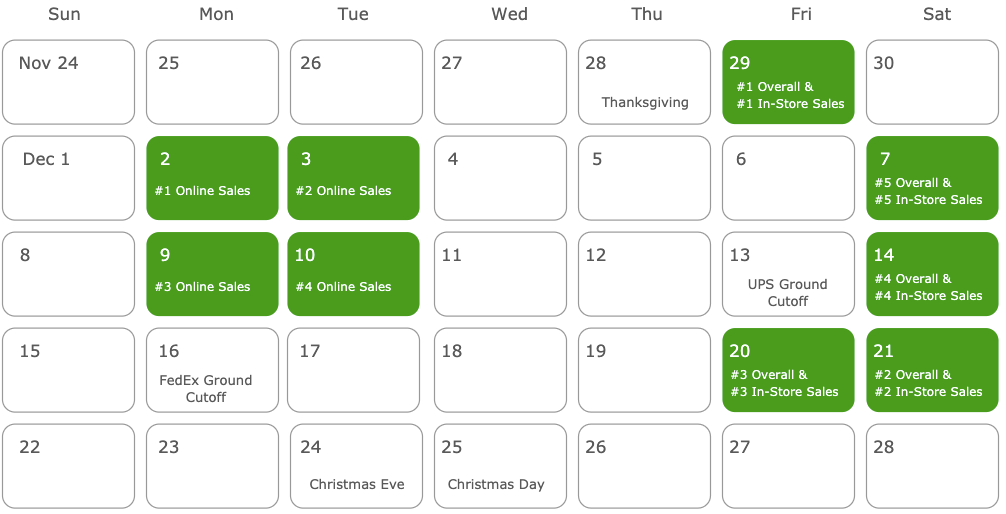

- Black Friday is by far the highest shopping sales day online and in-stores followed by the Saturday before Christmas, Dec 21.

- 64% of US consumers are using multiple channels for a single transaction. (Source: SalesForce)

- Last year holiday traffic from social channels grew 22% from 2017. The growth this years is expected to be even higher. (Source: SalesForce)

- 84% of customers say the experience a company provides is AS important as its products and services. (Source: SalesForce)

- Over 50% of shoppers plan to buy something for themselves. Clothing & shoes (20%) will be among to top items purchased. (Source: JLL)

- 59% of US consumers would like to receive gift cards followed by 52% wanting clothing & clothing accessories. (Source: Winter Holidays Data Center)

- 56% of US consumers will shop online during the holiday season with 70% looking for sales and discounts. (Source: Winter Holidays Data Center)

- Over 50% of shoppers say online video has helped them decide on a brand or product to buy.(Source : Google)

- Shoppers are starting earlier, with 5.1% stating they will start shopping on Thanksgiving, up from 3.4% in 2018. (Source: JLL)

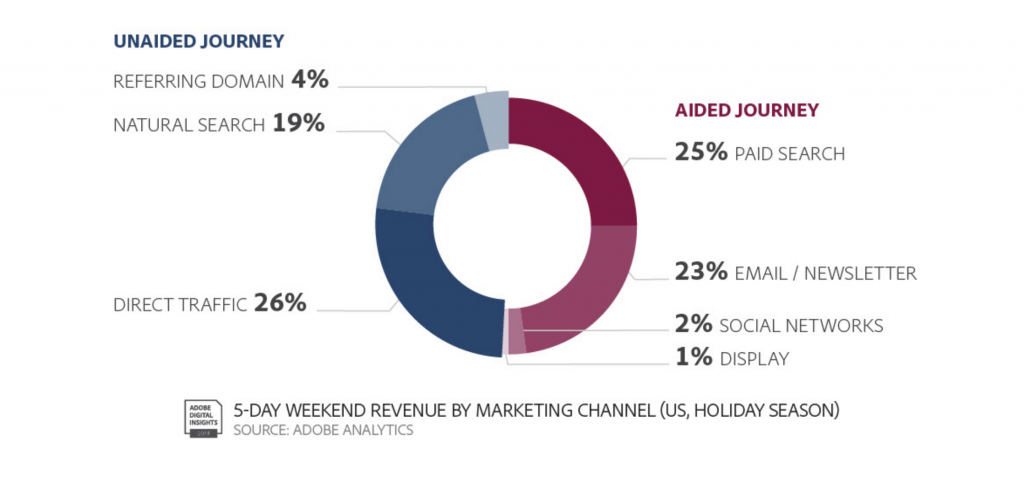

- 50% of online holiday revenue can be attributed to marketing directly impacting the customer journey (like paid search, email, social, etc), while 50% came from unaided tactics like direct, and organic search). (Source : Adobe)

- Click-and-collect shopping will continue to making it easier for shoppers to pick up locally after purchasing online and grew 50% in 2018. (Source: WWD)

- GenZ shoppers are 3.5 times more likely than Baby Boomers to use emerging shopping platforms, according to Salesforce data. (Source: WWD)

- High spenders ($2,100+) are expected to account for 60 percent of total holiday spend. (Source : Deloitte)

- GenX is expected to make up 35% of holiday shopping spend, followed by Baby Boomers at 31% and Millennials at 27%. (Source : Deloitte)

- 78% of shoppers will spend the same or more than they did in 2018 (Source : Deloitte)